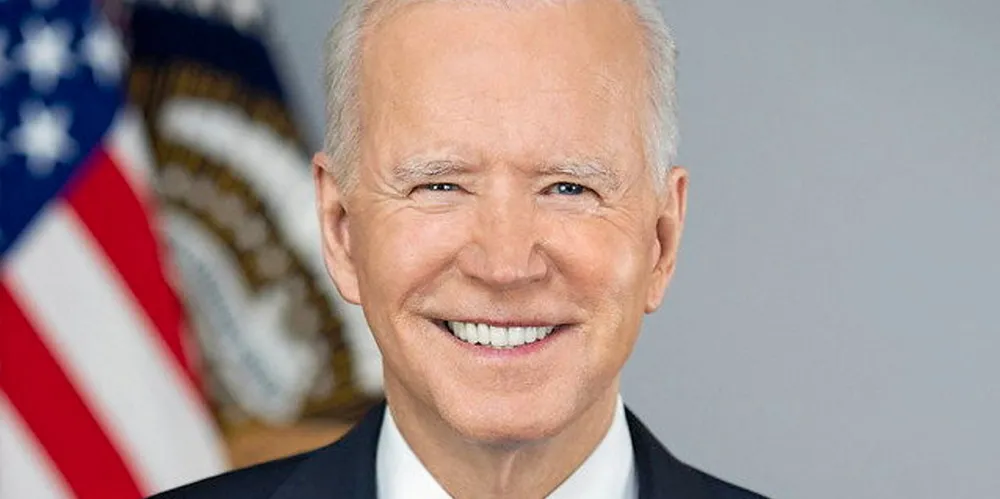

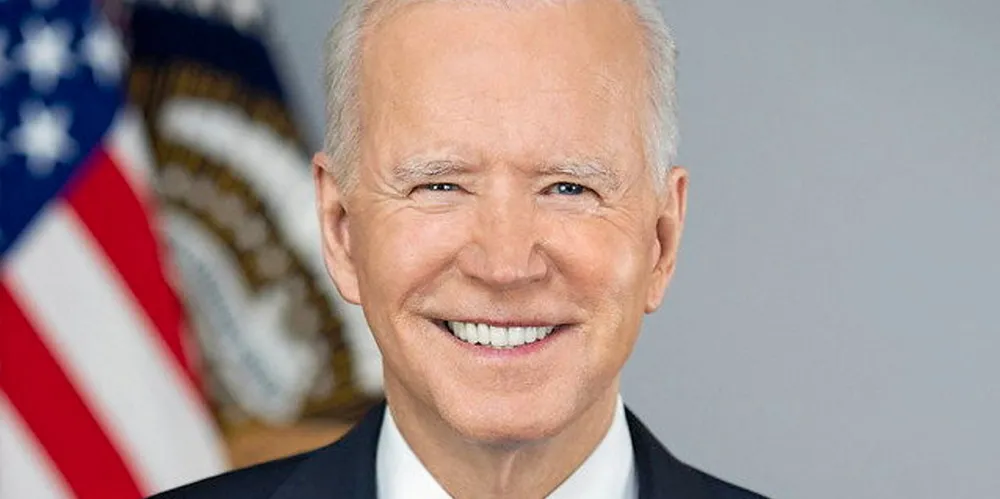

Green powerlines and good-paying jobs: Biden unveils $2.3trn US infrastructure plan

President proposes tax credit-driven mobilisation of 'tens of billions of dollars' of private capital to build world-class power network and create new employment

President proposes tax credit-driven mobilisation of 'tens of billions of dollars' of private capital to build world-class power network and create new employment