Floating wind supply chain plans 'key part' of landmark UK Celtic Sea round: Crown Estate

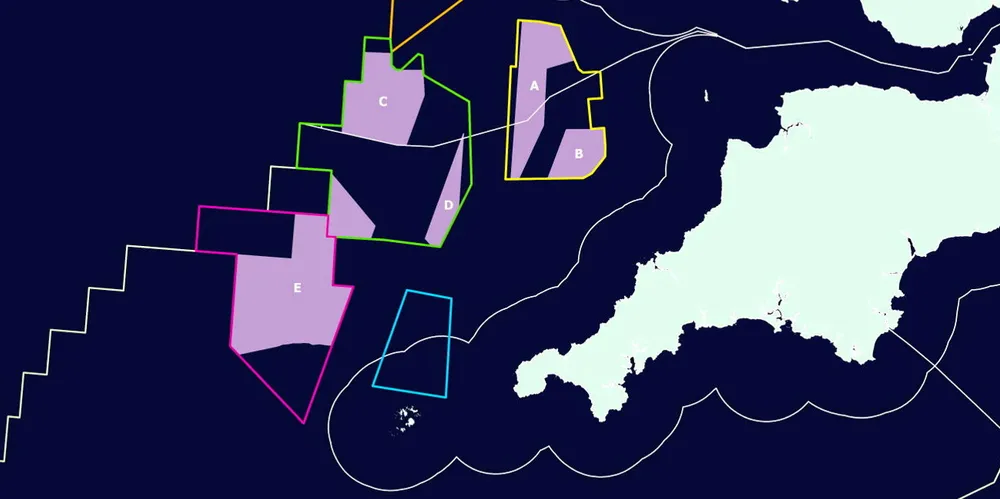

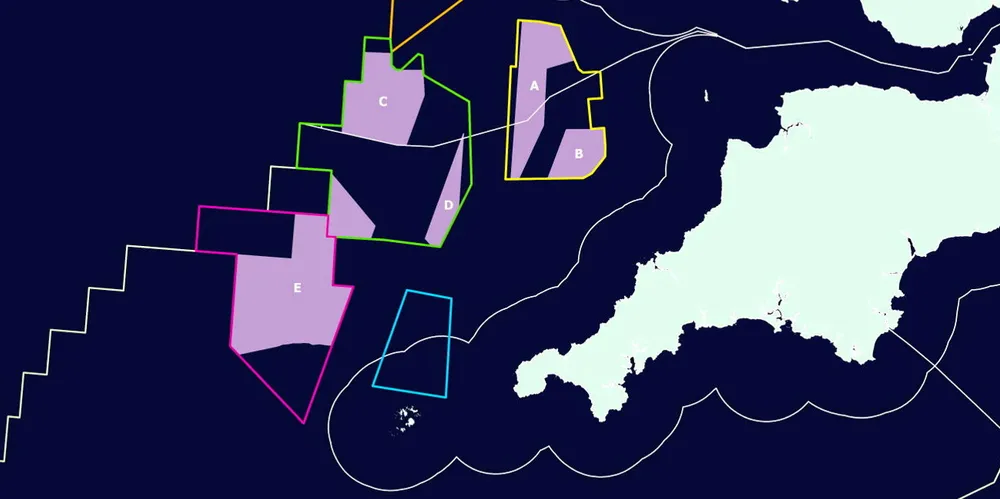

Seabed landlord to quiz developers over investment ambitions in leasing tender as potential project zones narrowed

Seabed landlord to quiz developers over investment ambitions in leasing tender as potential project zones narrowed