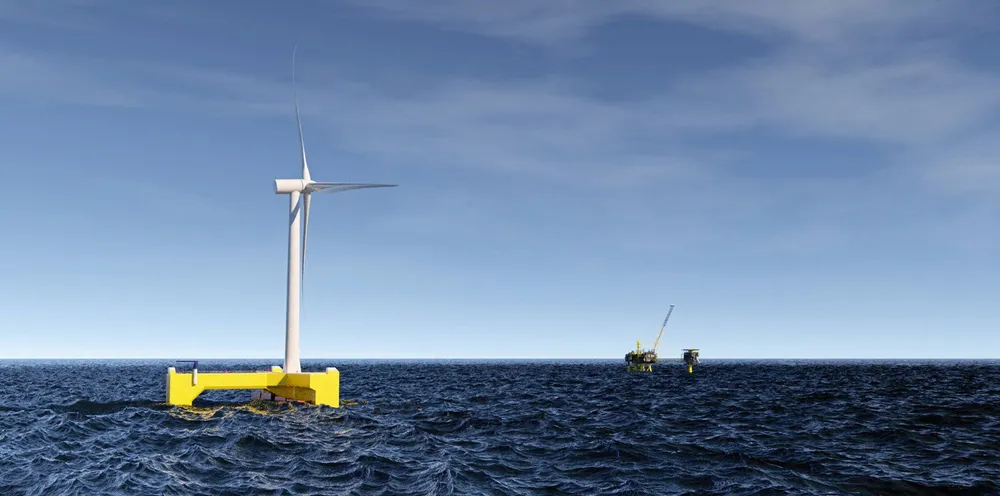

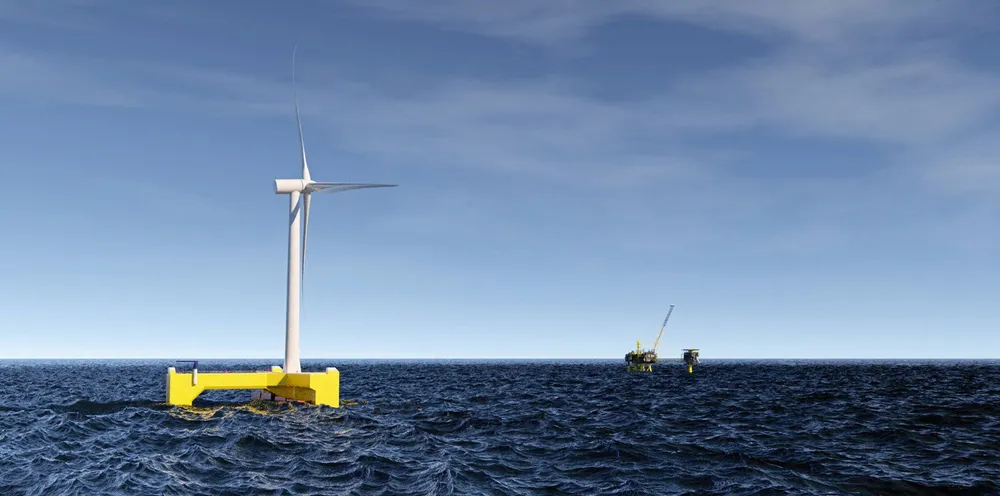

Floating wind power's new hydrogen horizons — a global offshore energy game-changer?

Growing appetite for green H2 has spurred the first offshore power-to-X plans, but deepwater plays might soon prove to be the bigger prize, writes Darius Snieckus

Growing appetite for green H2 has spurred the first offshore power-to-X plans, but deepwater plays might soon prove to be the bigger prize, writes Darius Snieckus