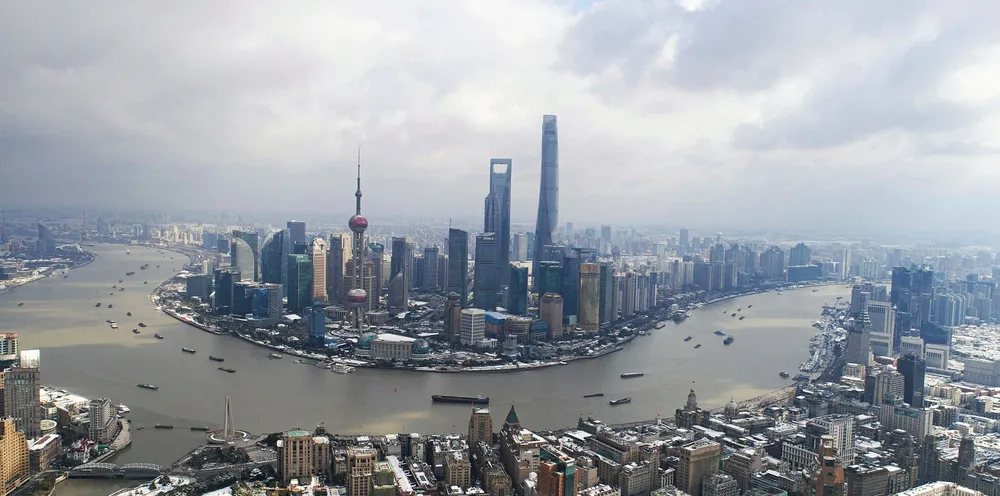

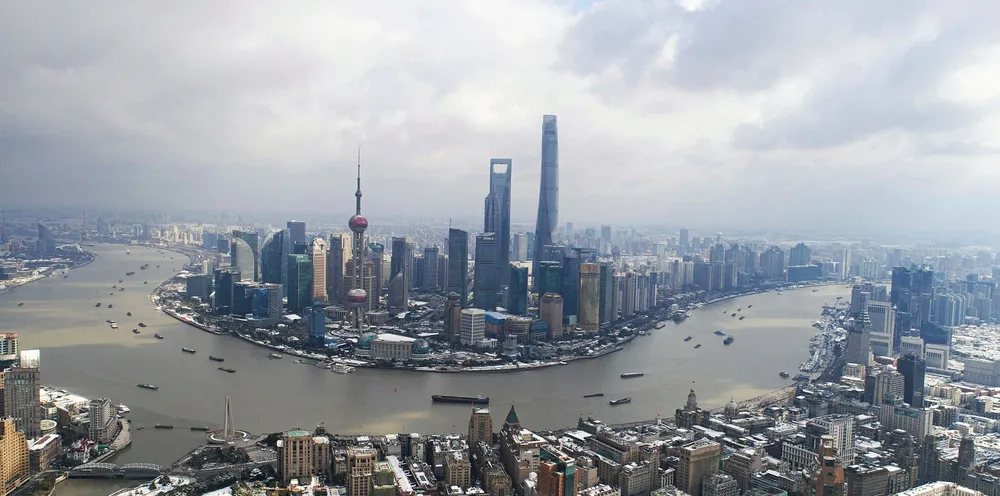

China offshore wind bid under $100/MWh in first price contest

Longyuan lodges bid equivalent to $88/MWh in nation's first price competition for 200MW off Shanghai

Longyuan lodges bid equivalent to $88/MWh in nation's first price competition for 200MW off Shanghai