Backlogged US clean energy interconnection queue 'slowing energy transition': ACP

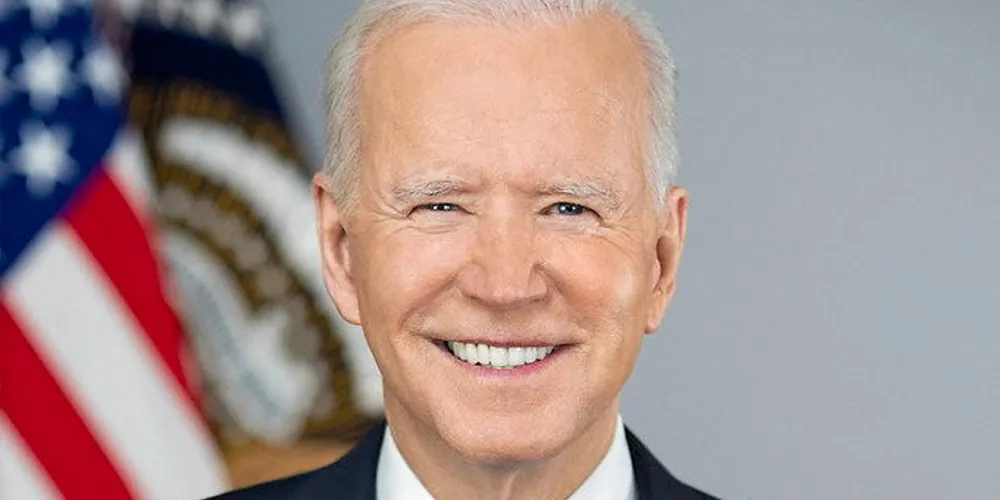

Gridlock of projects awaiting connection presents major hurdle to Biden decarbonisation strategy as renewables capacity waiting for switch-on now nearly as large as country's total generating fleet, says industry body