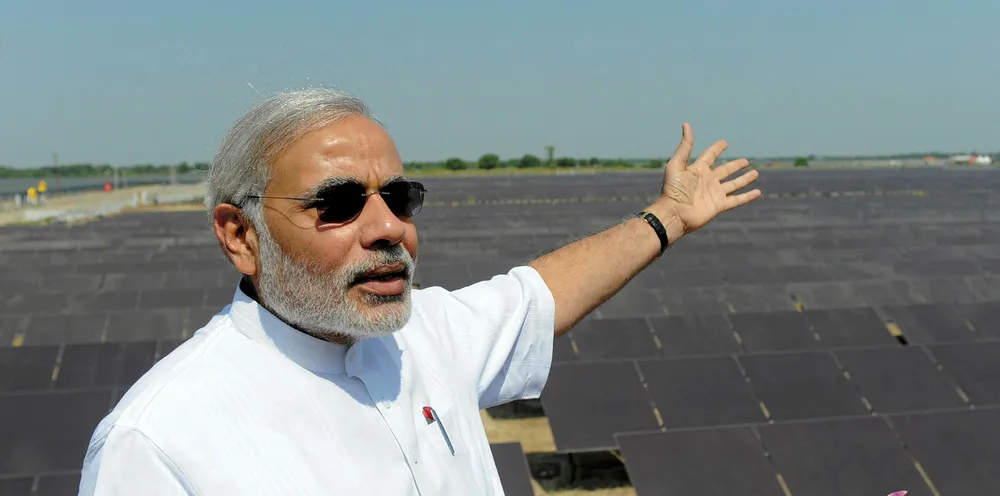

Wind and solar giants 'losing interest in incoherent India'

Policy headwinds mean nation is set to miss flagship renewable goals, warns financial ratings agency

Policy headwinds mean nation is set to miss flagship renewable goals, warns financial ratings agency