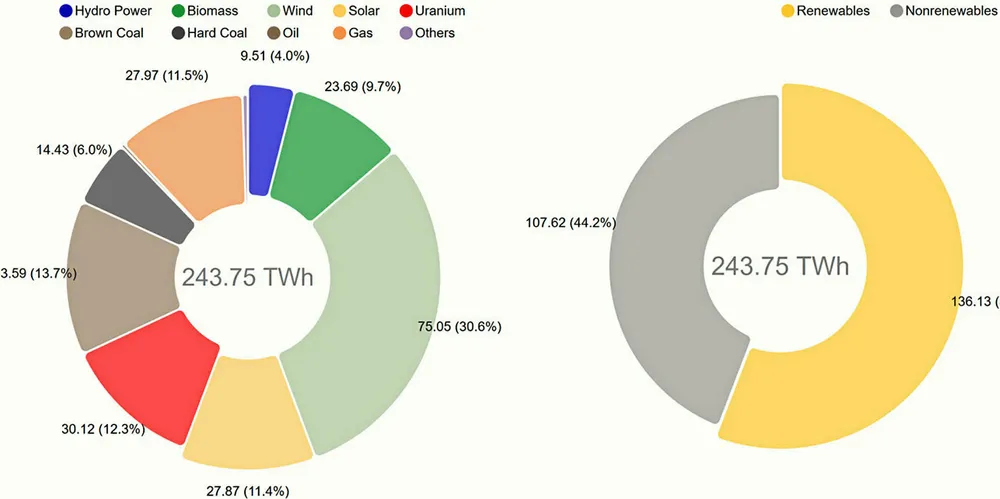

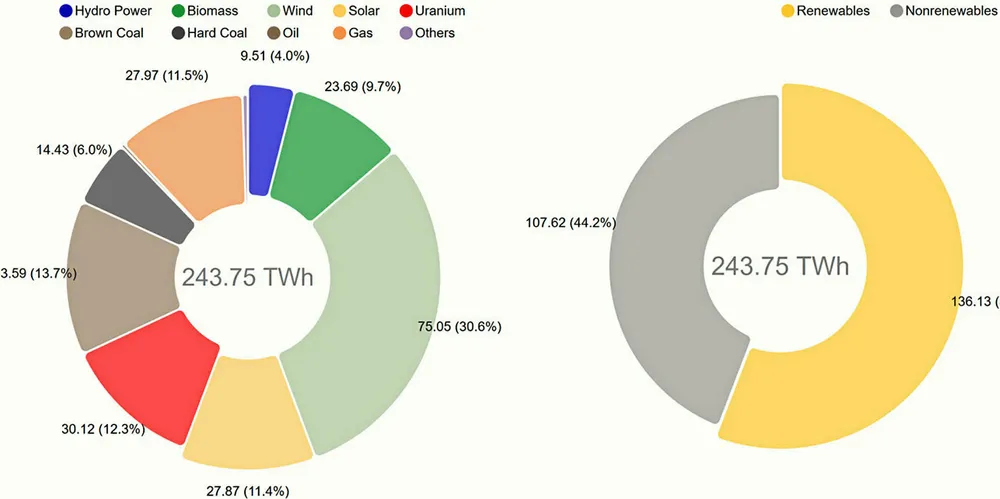

Germany’s renewable power share surges to 56% amid Covid-19 impact

Wind becomes the biggest power source in Europe’s largest economy with a 30.6% share in generation, while PV reaches 11.7%

Wind becomes the biggest power source in Europe’s largest economy with a 30.6% share in generation, while PV reaches 11.7%