‘Greener-than-green hydrogen to be produced at same cost as grey H2 at world’s largest facility’

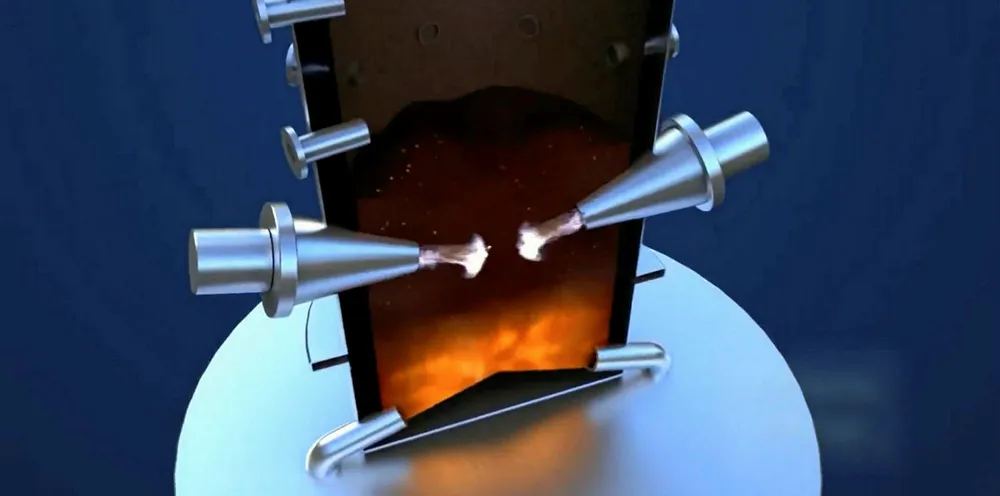

US start-up's plasma-enhanced gasification plant, due to be completed in 2022, could be a major breakthrough for the much-needed zero-carbon fuel, writes Leigh Collins