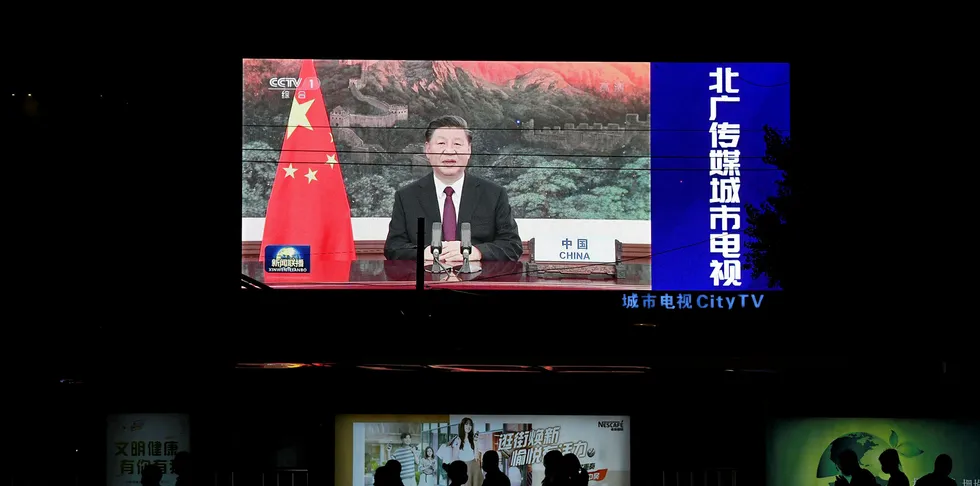

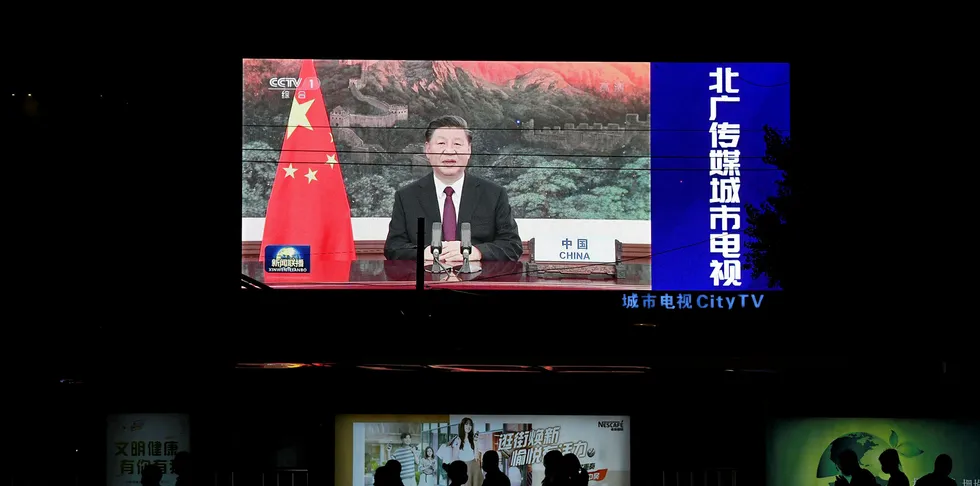

China eyes dash to terawatt of renewables as Xi sets carbon-neutral course

Key power sector bodies propose massive five-year increases as president unveils 2060 goal

Key power sector bodies propose massive five-year increases as president unveils 2060 goal