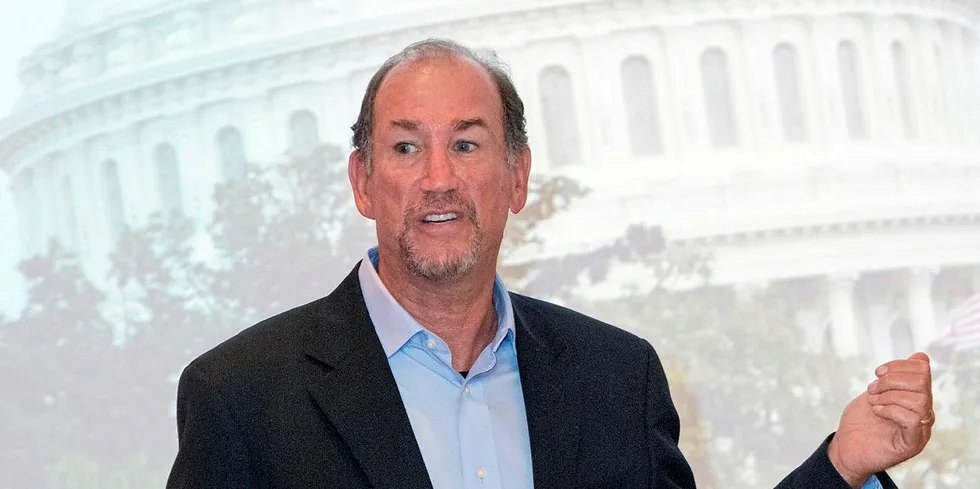

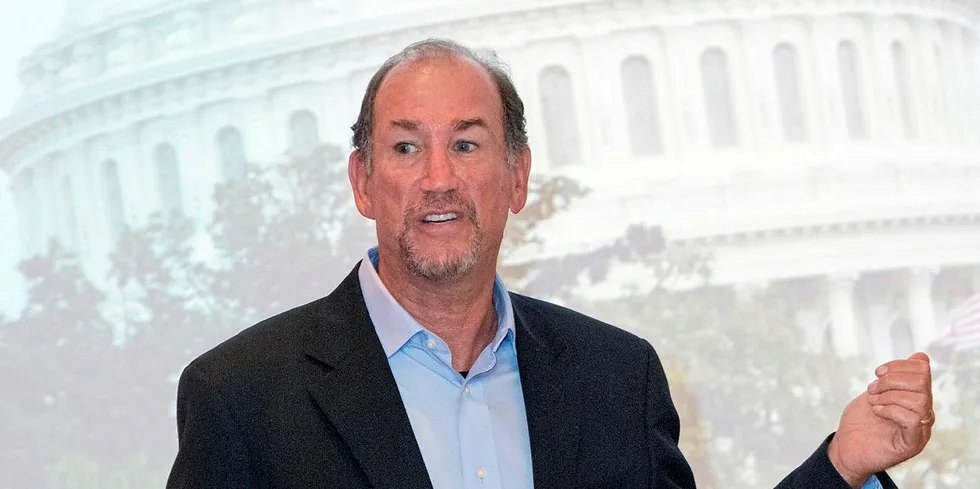

Progress on Acore $1trn clean-energy capital drive hit by 'near-term headwinds'

Investment one-eighth of way to target but yearly spending commitments will need to be upped by 28% to reach goal, says advocacy group

Investment one-eighth of way to target but yearly spending commitments will need to be upped by 28% to reach goal, says advocacy group