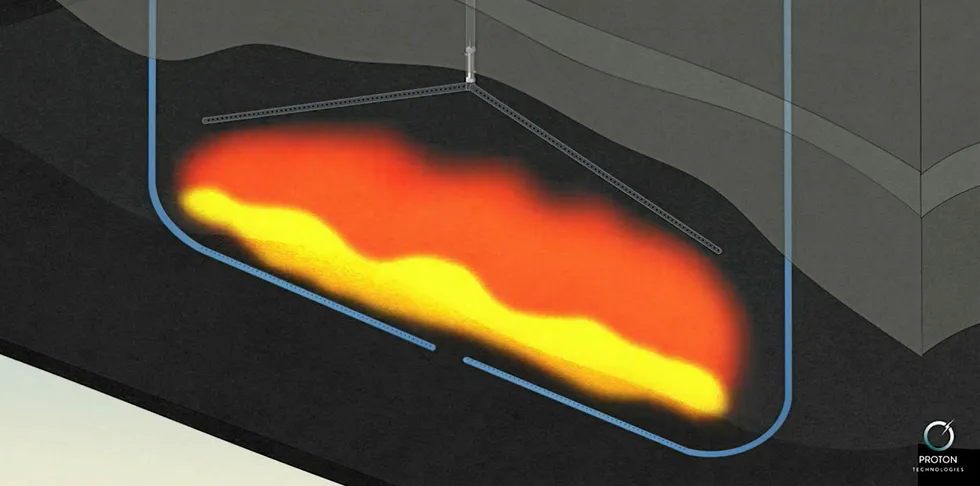

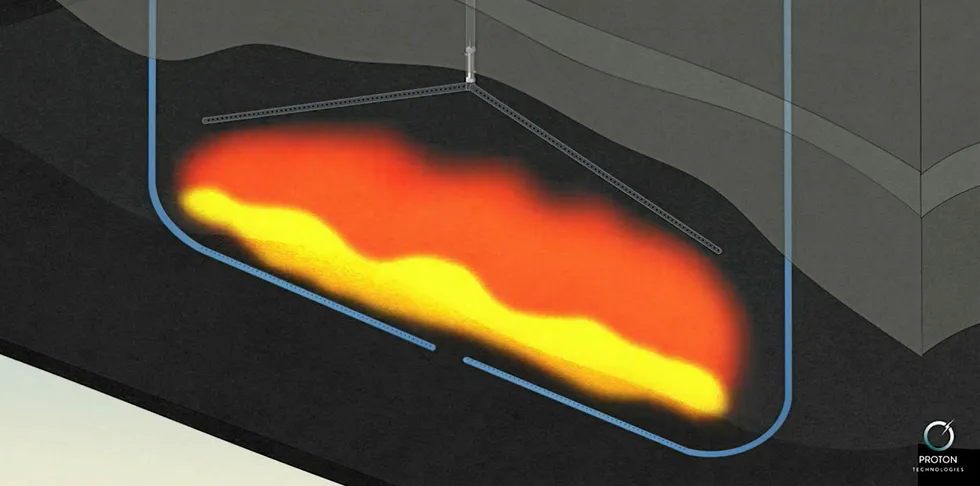

Low-cost, clean hydrogen from underground oil fires could kill off green H2 sector

The process now being real-world tested by a Canadian start-up could produce vast amounts of hydrogen up to ten times more cheaply than existing methods

The process now being real-world tested by a Canadian start-up could produce vast amounts of hydrogen up to ten times more cheaply than existing methods