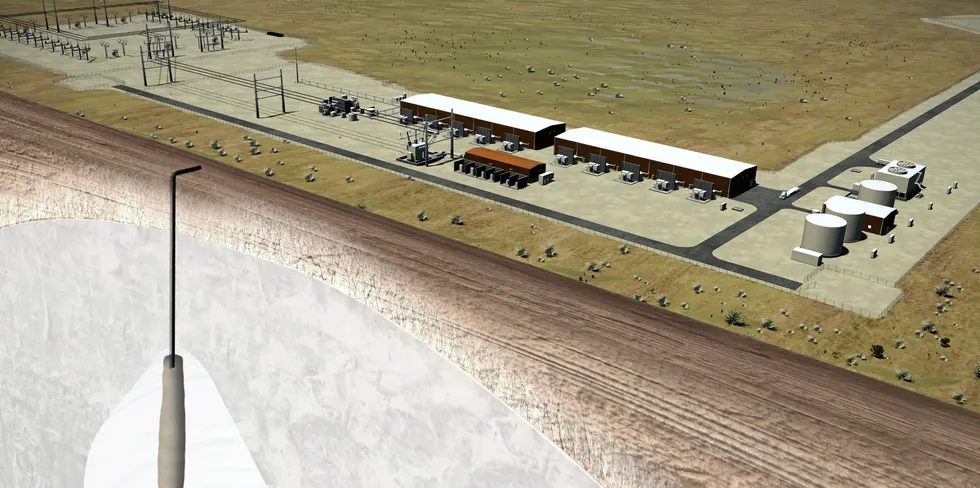

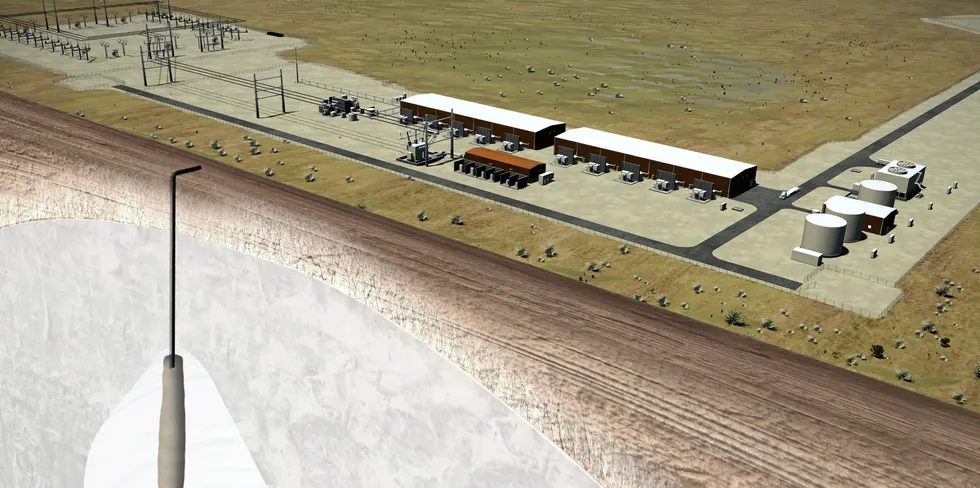

US government pledges $500m for nation's first large-scale green hydrogen project

Conditional loan from the Department of Energy will be used to support construction of 220MW facility in Utah by Mitsubishi Power and Magnum

Conditional loan from the Department of Energy will be used to support construction of 220MW facility in Utah by Mitsubishi Power and Magnum