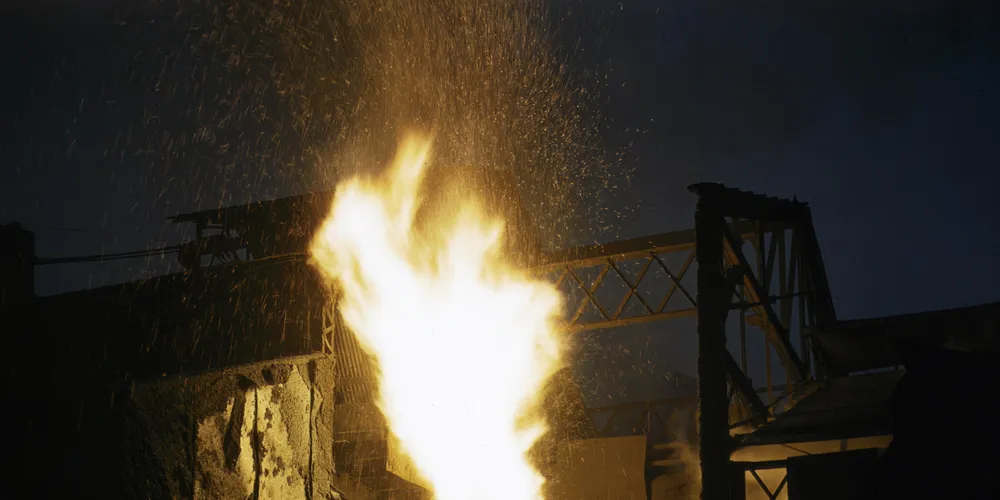

High-price US steel could hit 'viability' of offshore wind projects in New York: Nyserda

American-made supply chain hopes could founder on realities of scarcity of industrial capacity that could drive up costs and eat into local economic development benefits, concludes agency study