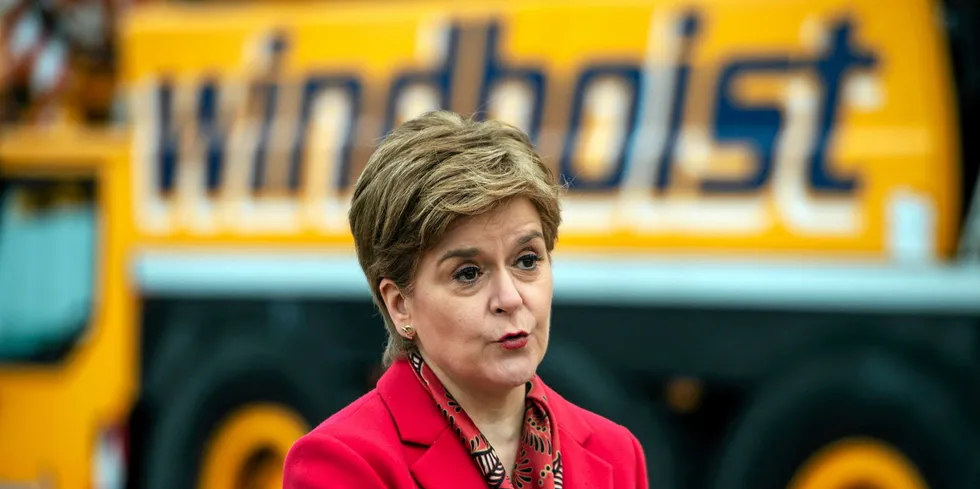

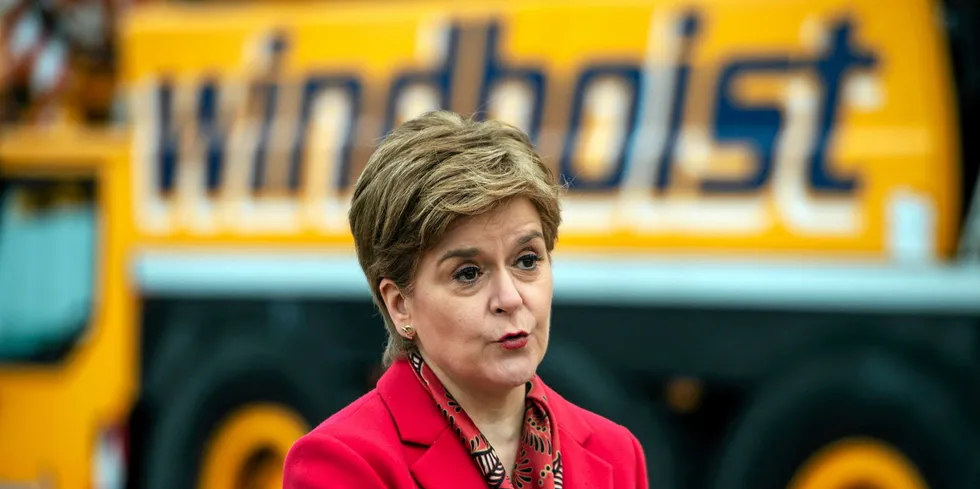

Power and oil giants win big as $1bn ScotWind 'puts Scotland in global offshore forefront'

Roll-call of big-hitters secure seabed leasing options for potential 25GW in milestone round for offshore wind sector that includes huge floating developments

Roll-call of big-hitters secure seabed leasing options for potential 25GW in milestone round for offshore wind sector that includes huge floating developments