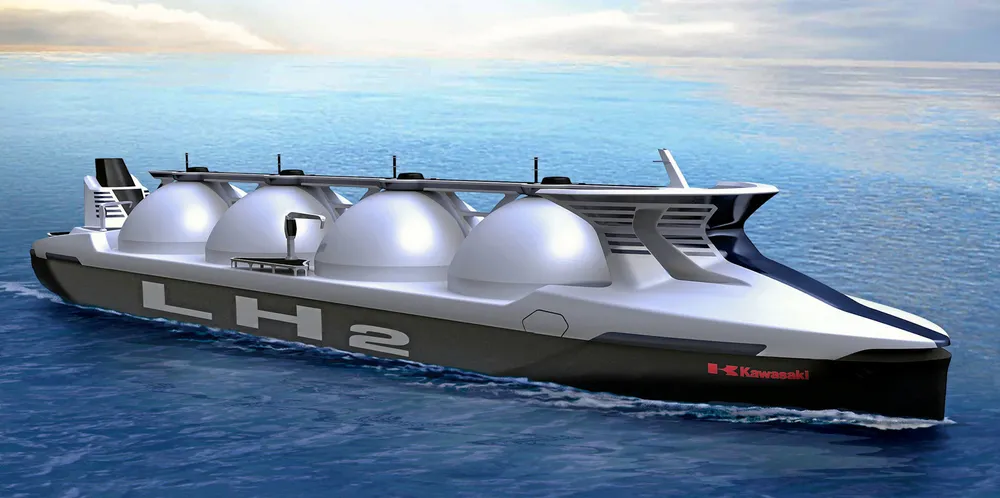

'Mastering' global hydrogen trade could speed energy export kingpins' transitions

Up-to-six-fold increase in international demand for H2, with a third of seaborne energy trade in a net zero world linked to the low-carbon gas, by 2050, forecasts WoodMac