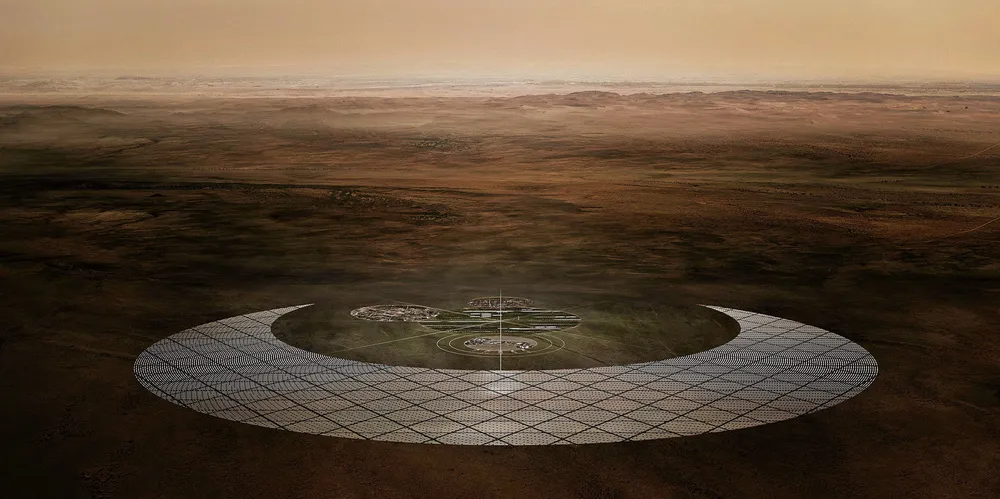

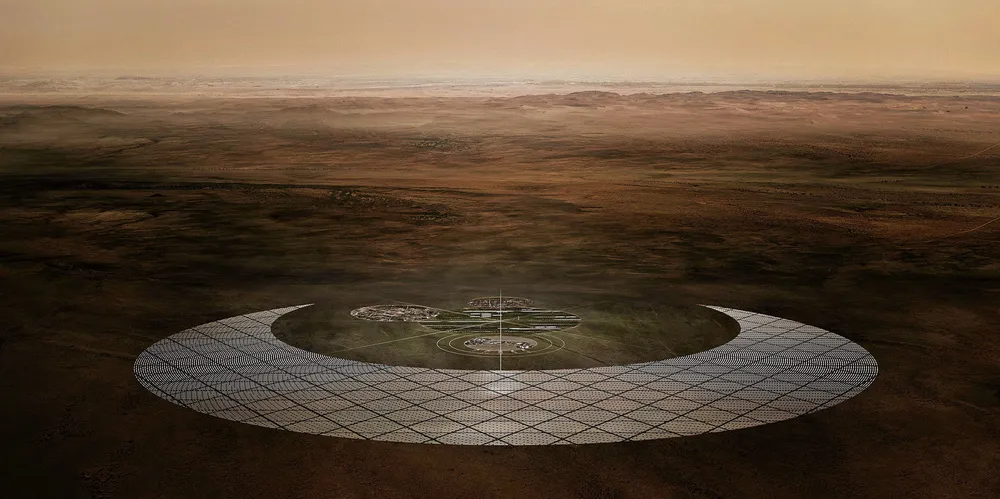

Vast 'Megaton Moon' plan eyes 60GW of wind and solar for green hydrogen

Danish developer says ambitious project can make Mauritania into global renewable fuels hub

Danish developer says ambitious project can make Mauritania into global renewable fuels hub