US solar future facing 'critical moment' as supply chain and trade shadows grow

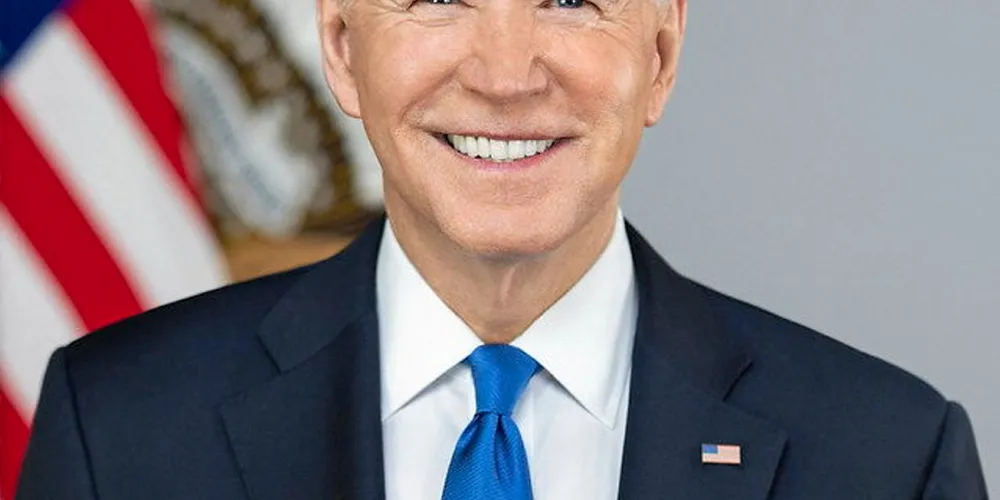

President Joe Biden's heavily PV-dependent net zero ambitions complicated by contractor pinch-points and rising component prices from Chinese suppliers, report from SEIA finds

The US’ ability to achieve carbon-free electricity and combat global heating is at risk because of increasing solar prices, along with supply chain and trade challenges, according to the Solar Energy Industries Association (SEIA).

“This is a critical moment for our climate future but price increases, supply chain disruptions and a series of trade risks are threatening our ability to decarbonise the electric grid,” said SEIA CEO Abigail Ross Hopper.

“If we want to incentivise domestic manufacturing and drive enough solar deployment to tackle the climate crisis, we must see action from our federal leaders.”

Solar accounted for 56% of all new electricity-generating capacity added in the US in the first half of 2021.

This is the first time that solar prices have increased quarter-over-quarter and year-over-year in every market segment since WoodMac began modelling system price data in 2014. This will stoke concerns that the sustained decline over the last decade in the cost of solar energy may be ending.

President Joe Biden has committed the US to reducing greenhouse gas emissions 50-52% by 2030 from 2005 levels and to reaching net-zero emissions by 2050, which is consistent with the Paris Agreement. To help get there, he wants to aggressively cut reliance on fossil fuels for power generation and eliminate them by 2035.

Solar factors large in his administration’s energy transition plans. Last week, the Department of Energy released a landmark report that called PV the “cheapest and fast-growing source of clean energy” that could provide at least 37% of the nation’s electricity by 2035 and 44% by mid-century versus 3% today.

The solar industry, however, is heavily dependent on China for components, and to supply and process many of the critical minerals used in their production. Biden wants to end that dependency but doing that faces a raft of environmental, financing, permitting, political, and other hurdles.

The roughly $1trn Infrastructure Investment and Jobs Act passed last month by the US Senate addressed several of these challenges such as infrastructure permitting reform and critical minerals. It did appear to advance much of Biden’s vision for a “Made in America” clean energy manufacturing chain free of Chinese influence.

Aluminium and steel price hikes

The most significant hikes came from higher input costs such as aluminium and steel, and elevated freight costs. As a result, prices rose more for utility solar because equipment for these projects, namely modules, tends to be sourced internationally.

“The solar industry continues to demonstrate strong quarterly growth, and demand is high across every segment,” said Michelle Davis, principal analyst at Wood Mackenzie and lead author of the report.

“But the industry is now bumping up against multiple challenges, from elevated equipment prices to complex interconnection processes. Addressing these challenges will be critical to expanding the industry’s growth and meeting clean energy targets,” she added.

Developers are responding in different ways. Some have renegotiated PPAs, while others are honouring existing contracts and accepting lower margins. All of them are cutting costs and adding contract language to account for potential price increases for equipment.

“New contracts initiated today will certainly be more expensive, and customers will have shorter time frames to decide on offered prices,” according to the report.

While supply chain constraints are unlikely to negatively impact long-term demand, projects are more likely to suffer delays and some are “already suffering, particularly those that can’t currently receive equipment,” the report noted.

Downside risks from trade actions

The US government’s withhold and release order (WRO) in June on metallurgical-grade silicon (MGS) from certain suppliers with facilities in China’s Xinjiang region added to the complexity of the industry’s supply chain constraints here. Last month, the first enforcement of about 100MW of equipment was detained from a leading module vendor.

This is a concern for the industry because of the high burden of proof required by US Customers and Border Protection as it requires information on the source MGS for modules entering the US, according to WoodMac, and the inquiry process can last at least 90 days.

The WRO “represents a significant, widespread downside risk to our near-tern outlooks”, said the report.

Unnamed companies here are also asking the Biden administration to impose the same anti-dumping and countervailing duties now being applied to Chinese crystalline silicon cells and modules to certain firms using Chinese wafers for cell production in Malaysia, Thailand, and Vietnam.

These countries supply about 80% of crystalline silicon module imports, “and duties could average 50% or more, creating the potential for widespread module price impacts”, said WoodMac.

"While it's still to early to tell the likelihood of these trade actions, they clearly pose a significant risk to the industry," said the report.

(Copyright)