Embattled EDF stuck with $30bn bill from ailing nuclear fleet as utility makes massive loss

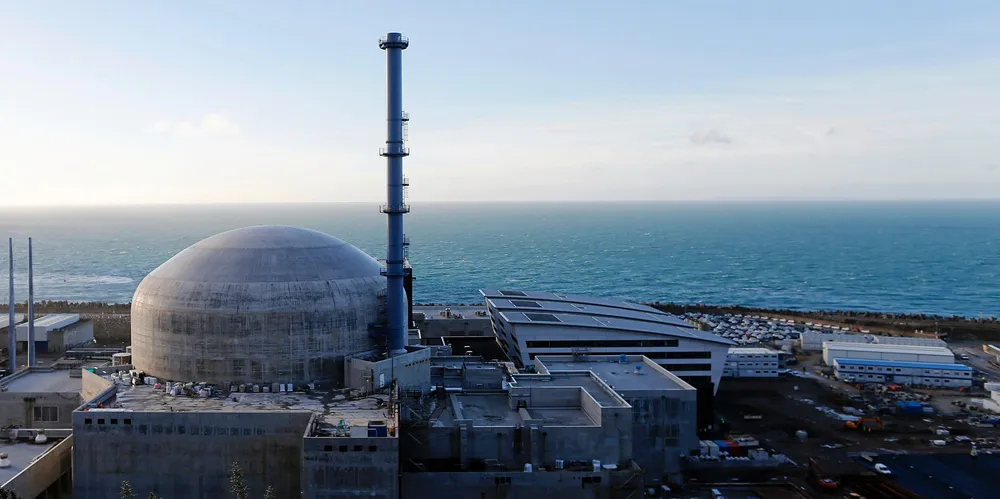

Despite corrosion leaving nearly half of French atomic power fleet idle last year and huge cost overruns at new construction, state-backed power comapny insists on building even more reactors