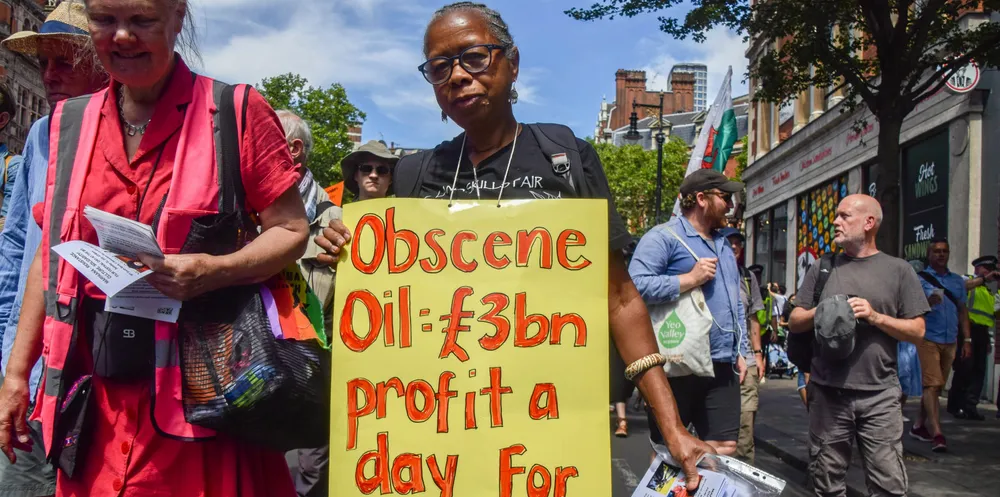

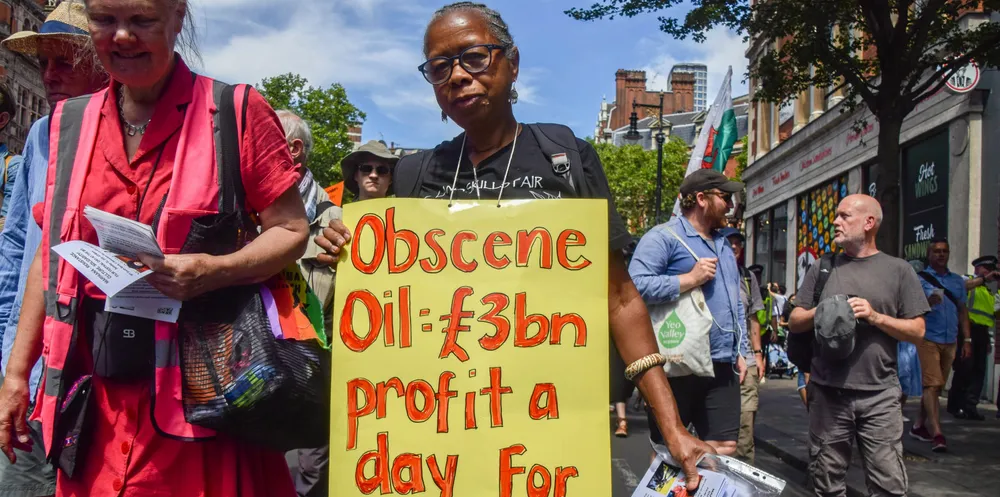

Renewable records and 'grotesque' fossils, Siemens Gamesa's wind of change, and making sense of Manchin

AGENDA | Our curation of the must-read news and analysis from the-week-that-was in the global renewable energy industry

AGENDA | Our curation of the must-read news and analysis from the-week-that-was in the global renewable energy industry