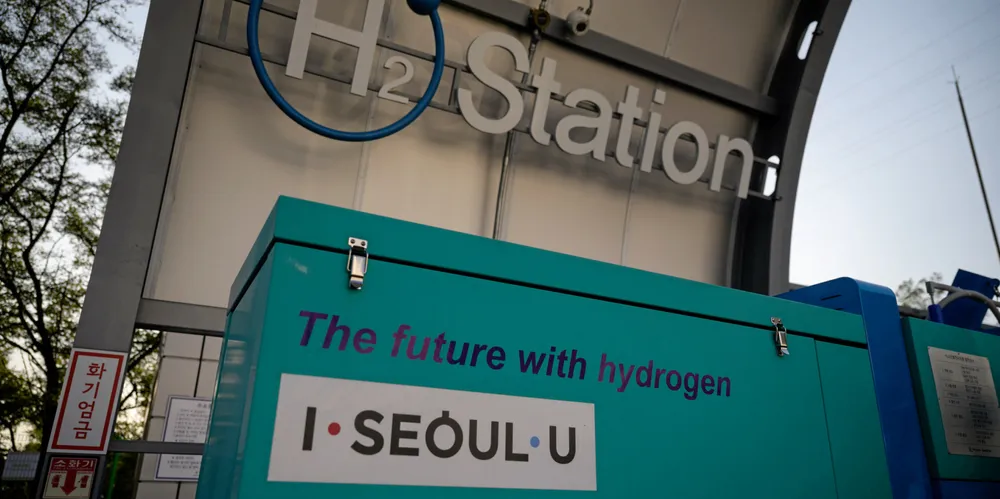

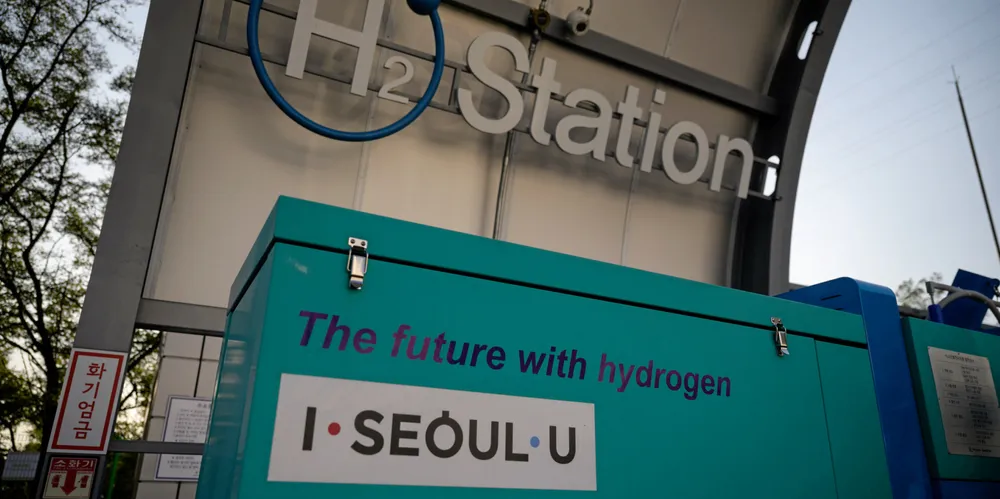

'Our largest energy source': South Korea plans 40 foreign hydrogen bases to meet vast future demand

Nation says investment and technology clout will secure supplies of 28 million tonnes a year by 2050

Nation says investment and technology clout will secure supplies of 28 million tonnes a year by 2050