Energy data outfit TGS' cash splash boots up new-model renewables AI start-up Nash

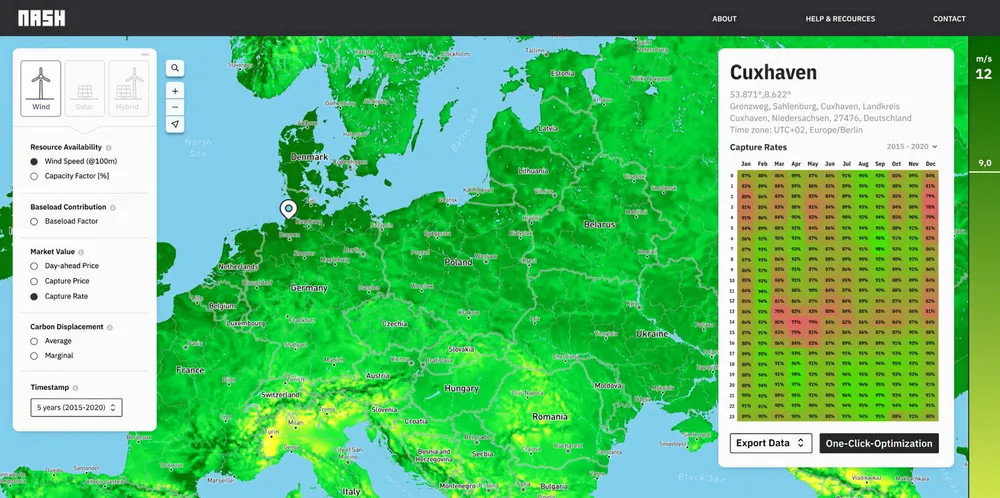

Transitioning energy analytics specialist makes first venture investment in a clean energy start-up with slice of software-as-service outfit launched by former Siemens Gamesa chief digital officer