'A year on, the IRA has made America the green envy of the world – but there's more to do'

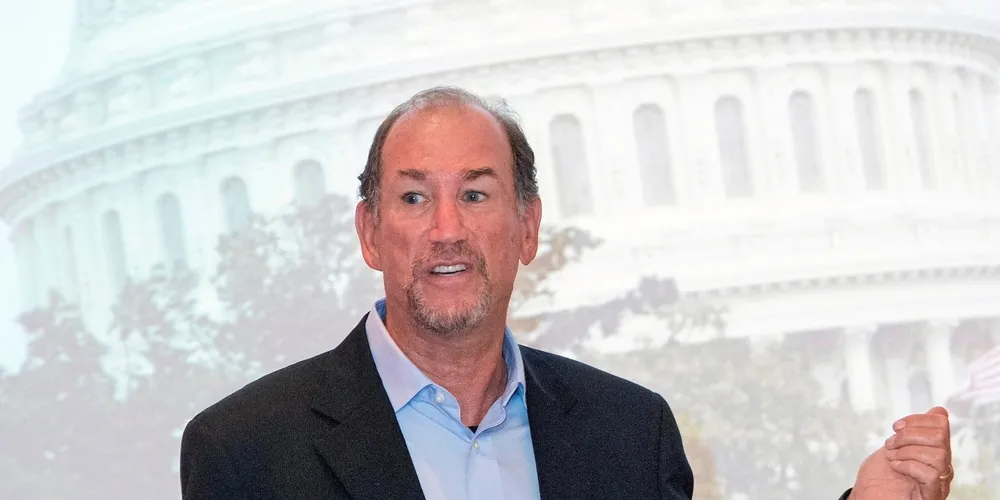

OPINION | The landmark bill has transformed sentiment among investors and developers to US renewable energy but also laid bare challenges yet to be met, writes Gregory Wetstone