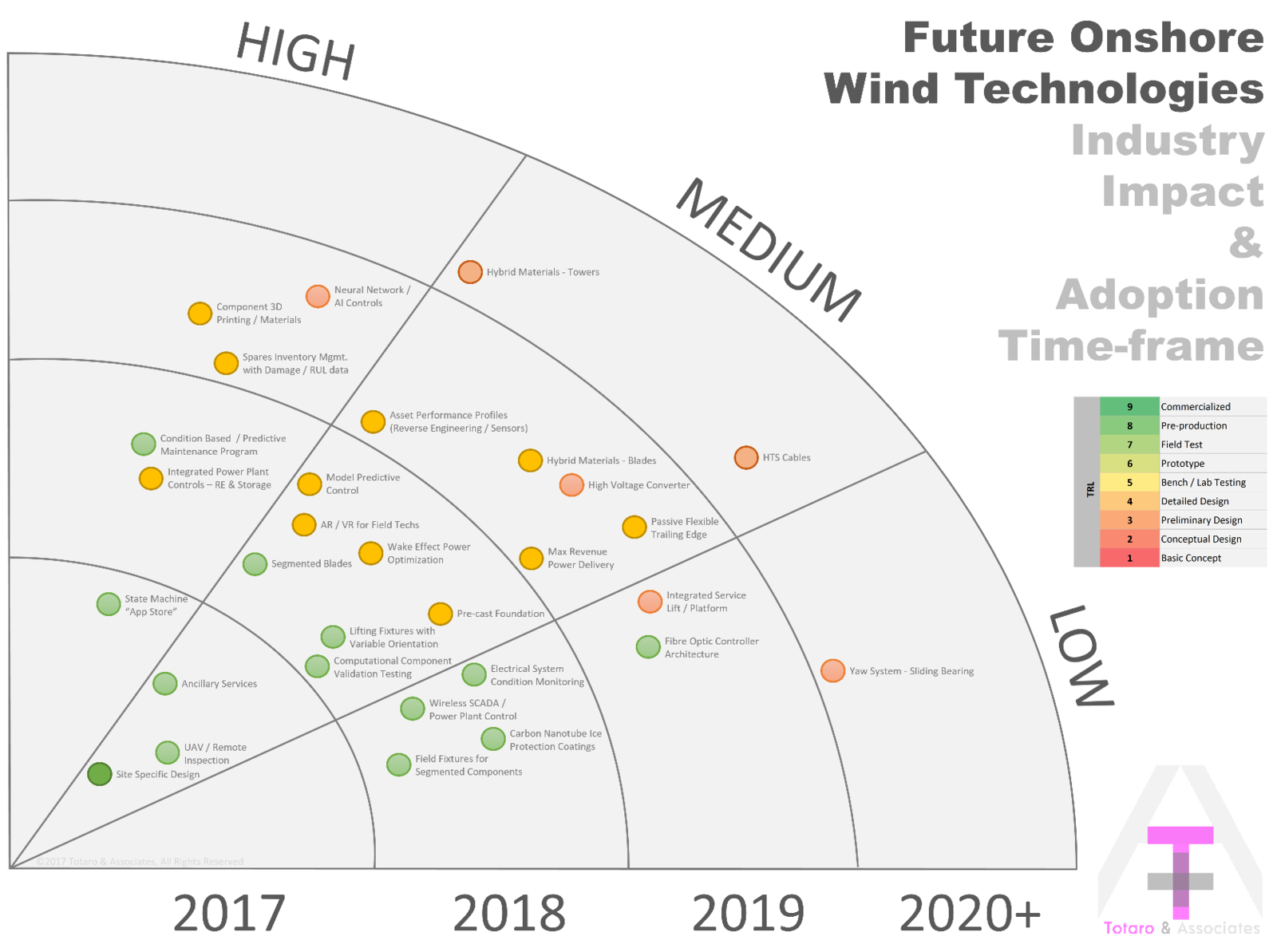

Renewable energy finds itself in a bit of a Catch-22 when it comes to innovation. Intrepid entrepreneurs with impressive ideas that would reduce levelised cost of energy (LCOE), improve annual energy production (AEP), reduce the capital cost of wind turbines, solar panels and energy storage systems, or even reduce the operating costs to maintain renewable-energy installations are being stifled.

Even OEMs have shown either incremental product and technology innovations, or pie-in-the-sky new products that have little hope of ever seeing the commercial market.

To