Delhi has set a target of 4-5GW of operational PV manufacturing capacity by the end of the National Solar Mission (NSM) second phase in 2017.

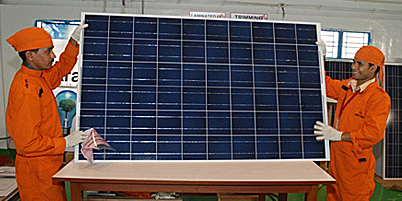

The country is keeping its head above water on the module side, with 1.5GW of capacity, according to Ivan Saha, Vikram Solar’s president and chief technology officer.

But Saha – formerly head of crystalline-silicon (c-Si) technology at Moser Baer – says a lack of cell capacity makes the domestic-content rule a “non-starter”.

Kolkata-based